Rate Structure Under GST & Tax Credit Mechanism

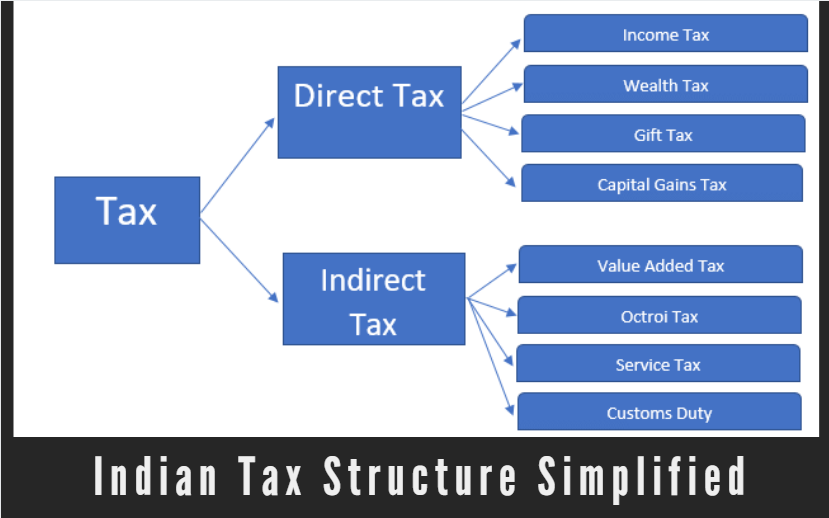

GST OVERVIEW The present indirect tax regime is complex and entails multiple taxes and duties. Further, there is a significant cascading effect of taxes on account of various restrictions on cross utilization of credit of one tax against another. In addition to this, the multiplicity of returns and compliances at State level, administrative costs, waybills […]

Rate Structure Under GST & Tax Credit Mechanism Read More »