Introduction

In recent years, India has witnessed a rapid transformation in its economic landscape, with businesses embracing digital technologies to enhance efficiency and transparency. One such significant step towards a digital future is the implementation of E-Invoicing. This groundbreaking initiative, launched by the Indian government, aims to revolutionize the way businesses generate, authenticate, and process invoices electronically. In this blog, we delve into the concept of E-Invoicing in India, its benefits, challenges, and the impact it has on businesses and the economy as a whole.

Understanding E-Invoicing

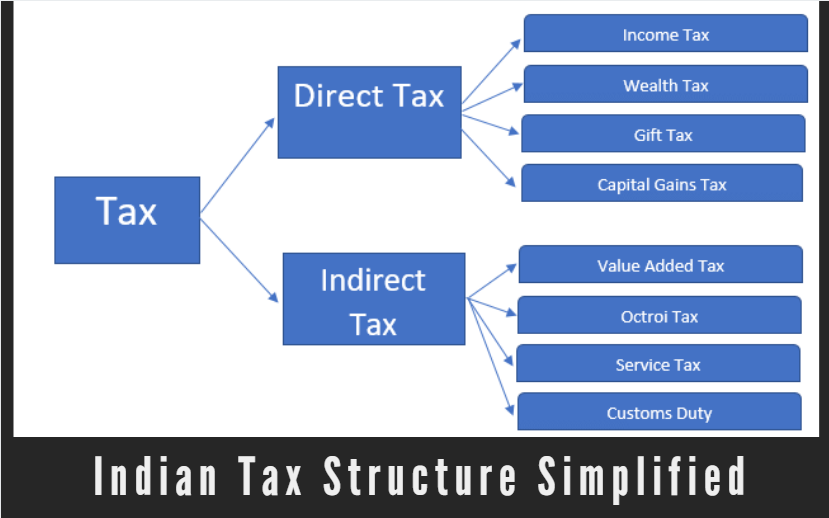

E-Invoicing, or Electronic Invoicing, refers to the digital generation and exchange of invoices between suppliers and buyers. It involves the use of standardized formats, such as JSON or XML, to facilitate seamless communication between accounting systems of businesses. The main goal of E-Invoicing is to eliminate manual intervention, reduce paperwork, and ensure the authenticity of invoices, thereby minimizing tax evasion and promoting a more transparent and efficient business ecosystem.

The Indian Context

In India, the journey towards adopting E-Invoicing began in 2020, with the implementation of the Goods and Services Tax (GST) E-Invoicing system for businesses with a certain threshold turnover. The rollout was executed in a phased manner to ensure smooth adoption and to allow businesses to adapt to the new digital infrastructure.

The Benefits of E-Invoicing

While E-Invoicing presents numerous advantages, its widespread adoption comes with certain challenges:

- Technological Readiness: Smaller businesses might face difficulties in transitioning to the new digital system due to limited technological resources and expertise.

- Data Security and Privacy: The exchange of sensitive financial data over electronic channels raises concerns about data security and privacy breaches.

- Compliance Burden: Businesses need to ensure strict adherence to the GSTN guidelines and keep their systems updated to comply with the frequently changing regulatory requirements.

- Interoperability: Different accounting software and formats might lead to compatibility issues, hindering seamless integration between businesses.

Impact on Businesses and the Economy

E-Invoicing has brought about a positive impact on businesses, streamlining their operations and enabling them to adapt to a rapidly evolving digital landscape. With improved data accuracy and transparency, businesses can make more informed decisions, leading to better growth prospects and increased competitiveness.

Additionally, the Indian economy benefits from increased tax revenues as tax evasion reduces significantly. The government gains access to real-time data on transactions, helping them formulate better tax policies and track the economic health of various sectors.

Miracle Accounting Software Provides One Click E-Invoice Solution!!

Make your business more compliant with One Click![]() E-invoice solution in Miracle Accounting Software

E-invoice solution in Miracle Accounting Software

With Miracle, you don’t need to worry ![]() about generating E-invoices anymore, save time

about generating E-invoices anymore, save time![]() and generate them easily .

and generate them easily .

Update yourself on the latest business trends so that you can stay stress-free.

With Miracle Software You Can Say goodbye to traditional methods of sending invoices!

With Miracle accounting software, you can effortlessly send your e-invoices via

WhatsApp,

Telegram, and

E-mail.

Seamlessly communicate with your clients and streamline your billing process.

Also, Effortlessly manage your invoicing tasks with the Bulk E-invoice Facility in Miracle accounting software. Experience the power of automation and speed up your e-invoice generation.