If you’re involved in international trade, logistics, or even the day-to-day operations of a business, you’ve probably come across the term “HSN code” at some point. But what exactly is an HSN code, and why is it important? In this comprehensive guide, we’ll demystify HSN codes, explaining what they are, why they matter, and how they can benefit your business.

What is an HSN Code?

HSN stands for Harmonized System of Nomenclature, and an HSN code is a numerical code assigned to specific products or commodities to facilitate uniform classification and international trade. In essence, it’s a common language used by businesses, customs authorities, and governments worldwide to identify and categorize products in a standardized way.

The HSN code system was developed by the World Customs Organization (WCO) to simplify international trade and ensure consistency in classifying products across borders. It is widely adopted globally, making it an essential tool for anyone involved in the import or export of goods.

HSN in India

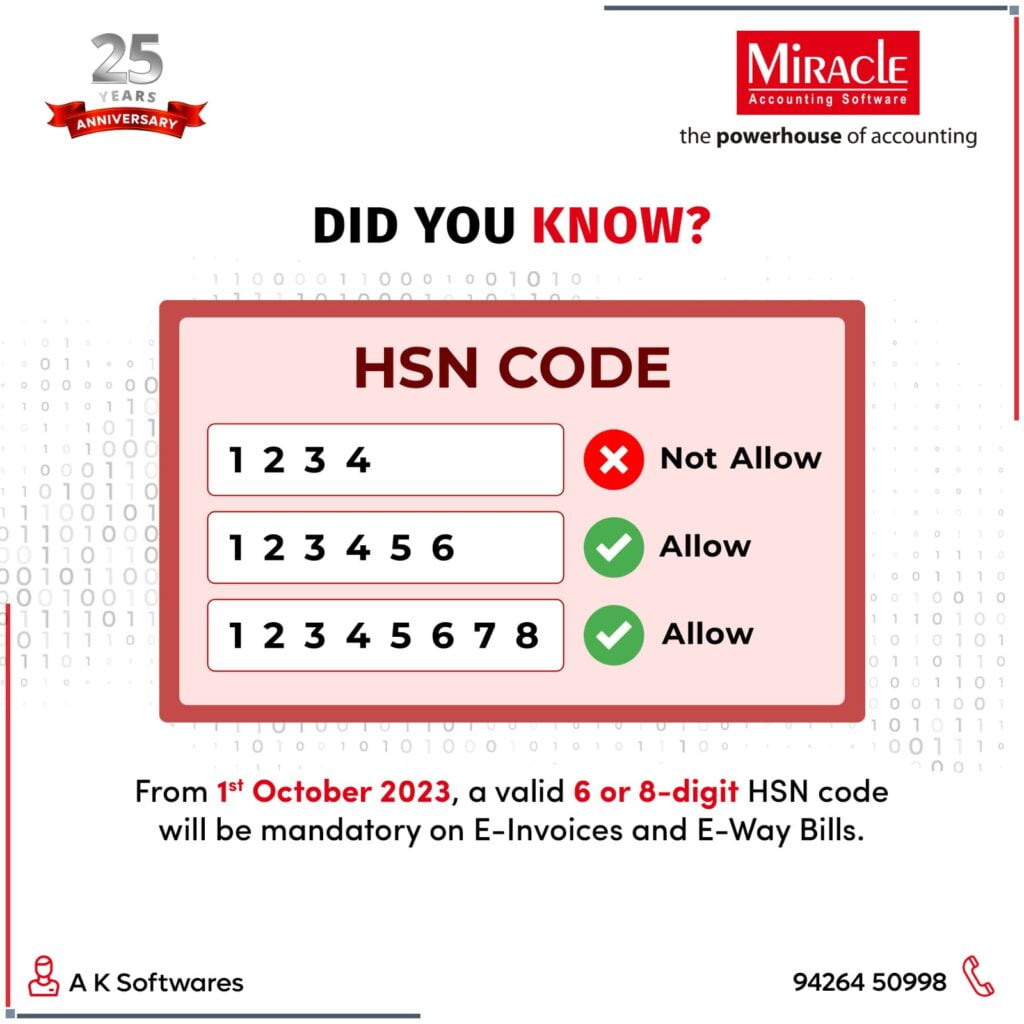

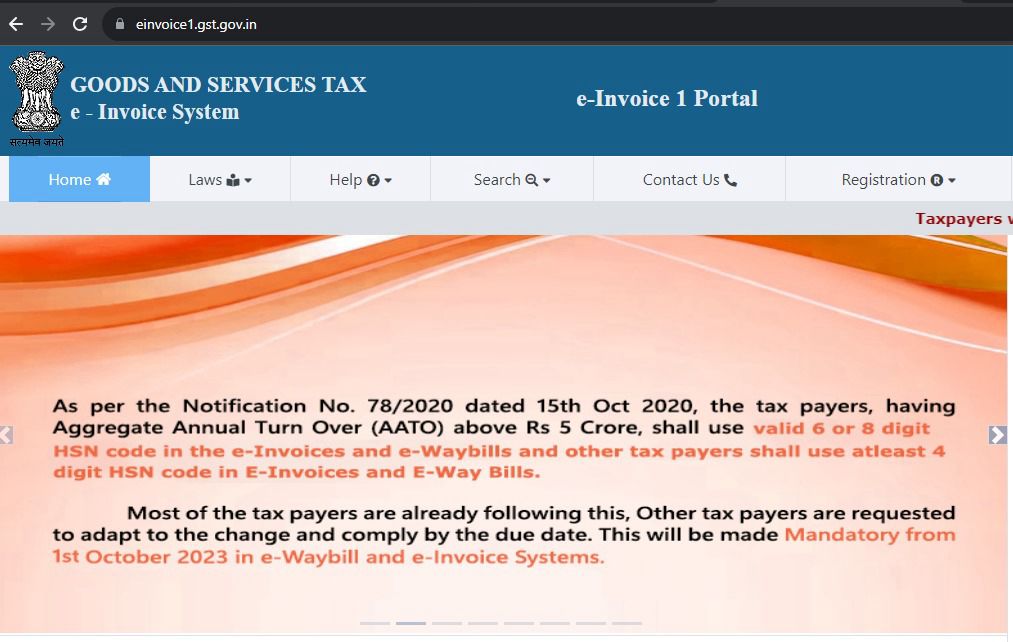

India has been a member of the World Customs Organization(WCO) since 1971. It was originally using 6-digit HSN codes to classify commodities for Customs and Central Excise. Later Customs and Central Excise added two more digits to make the codes more precise, resulting in an 8-digit classification.

Structure of an HSN Code

An HSN code typically consists of six to ten digits, arranged in a hierarchical structure. Each digit serves a specific purpose:

- Chapter: The first two digits represent the chapter of the HSN code, which broadly categorizes products into 21 sections, such as agricultural products, chemicals, machinery, textiles, and more.

- Heading: The next two digits define a more detailed product category within the chapter.

- Subheading: The next two digits provide further granularity, specifying the product’s characteristics or purpose.

- Tariff Item: The last two to four digits offer the most precise classification, often detailing specific features or materials used in the product.

Let’s break down an example: HSN Code 1006.10.00.00

- Chapter (10): Cereals

- Heading (06): Rice

- Subheading (10): Semi-milled or wholly-milled rice, whether or not polished or glazed

- Tariff Item (00.00): Specific product within this subcategory

Why Are HSN Codes Important?

1. International Trade Facilitation:

HSN codes are essential for customs authorities to determine import duties and taxes accurately. They streamline cross-border trade by ensuring that products are classified consistently worldwide.

2. Transparency and Standardization:

HSN codes provide a standardized way to describe products, reducing ambiguity and misclassification. This transparency benefits both buyers and sellers by ensuring everyone is on the same page.

3. Statistical Analysis:

Governments and organizations use HSN codes for statistical purposes, helping them track trade patterns, monitor industries, and make informed policy decisions.

4. Market Access:

Understanding HSN codes is crucial when expanding your business to international markets. It ensures compliance with local regulations and avoids potential issues at customs.

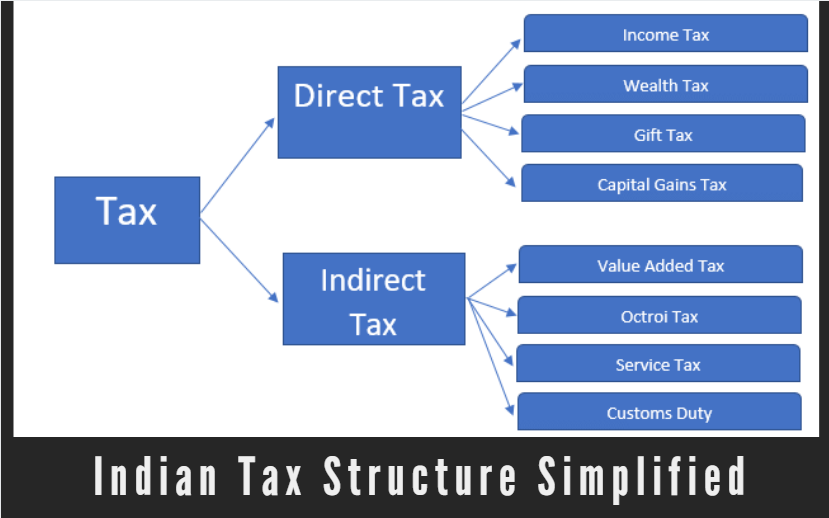

5. Taxation:

In some countries, the HSN code directly influences the rate of goods and services tax (GST) or value-added tax (VAT) applied to a product. Accurate classification is essential to calculate taxes correctly.

How to Find HSN Codes

Finding the correct HSN code for your product is essential to ensure smooth international trade operations. Here’s how you can find the right code:

- Government Websites: Most countries provide HSN code lists on their customs or taxation websites. These lists are usually searchable and free to access.

- Consulting Experts: If you’re unsure about the classification of a product, consider seeking advice from customs consultants or trade experts who specialize in HSN codes.

- Software Solutions: There are various software tools and databases available that can help you find the correct HSN code for your product.

Conclusion

HSN codes are the backbone of international trade, providing a common language for businesses and governments to classify products accurately. Understanding and correctly using HSN codes can save your business time, money, and potential headaches when navigating the complex world of global trade. So, whether you’re a seasoned international trader or just starting, make sure to embrace the power of HSN codes for smoother and more efficient cross-border transactions.