Accounting software for Chartered Accountants (CAs), accountants, and tax consultants should meet a range of requirements to effectively manage financial data, streamline workflows, and provide accurate services to clients. Here are some key requirements to consider when choosing accounting software for professionals in the financial industry:

- Comprehensive Accounting Features: The software should provide robust accounting capabilities, including general ledger management, accounts payable and receivable, bank reconciliation, journal entries, and financial reporting.

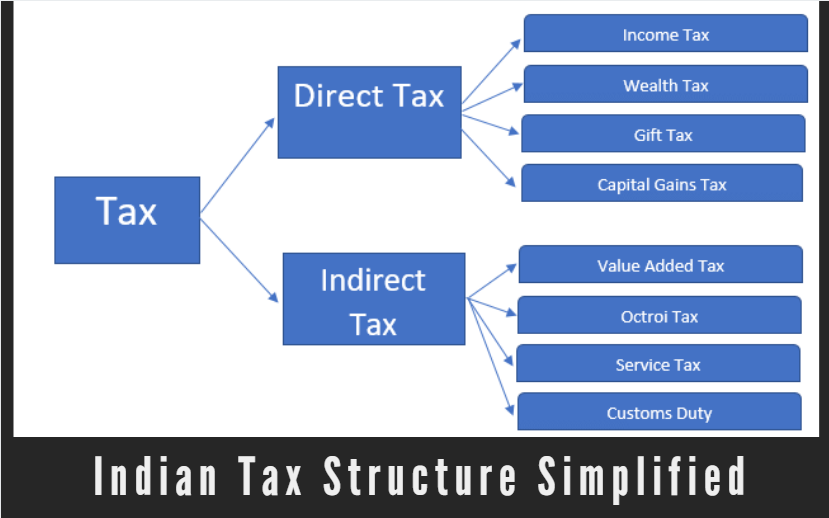

- Tax Management: The software should support tax preparation and filing, including features for calculating income tax, GST/VAT, sales tax, and other relevant taxes. It should also keep up-to-date with changing tax regulations.

- Multi-Client Support: For CAs and consultants managing multiple clients, the software should allow easy management of client data, financials, and documents in one central place.

- Data Security: Data security is critical. The software should have encryption, secure logins, role-based access controls, and regular data backups to safeguard sensitive financial information.

- Financial Reporting: The software should generate customizable financial reports such as profit and loss statements, balance sheets, cash flow statements, and other relevant reports to provide insights into clients’ financial health.

- Integration with Third-Party Apps: Integration with other software tools like CRM, document management, and communication tools can enhance efficiency and productivity.

- Client Collaboration: The software should allow easy collaboration with clients through document sharing, client portals, and secure communication channels.

- Automation and Workflow Management: Workflow automation features can help streamline processes, reduce errors, and save time. For example, automated invoice reminders, recurring transactions, and approval workflows.

- Scalability: As your practice grows, the software should be able to accommodate more clients and handle increased data volume.

- User-Friendly Interface: The software should have an intuitive and user-friendly interface that allows professionals to navigate and use the features effectively.

- Mobile Access: Mobile apps or responsive web interfaces can enable access to financial data and client information while on the go.

- Customer Support: Reliable customer support is essential to address any issues or queries that may arise during usage.

- Customization: Some software allows you to customize features and reports to fit your specific needs and branding.

- Compliance and Regulation: Ensure the software complies with industry standards and regulations, particularly if it deals with sensitive financial data.

- Cost and Pricing Model: Evaluate the software’s pricing model, whether it’s subscription-based, one-time purchase, or usage-based, to ensure it aligns with your budget.

Remember that every professional’s needs may vary, so it’s important to evaluate software options based on your specific requirements and preferences. It’s also a good idea to try out demos or trial versions of software before making a final decision.