The standard rate of Value Added Tax (VAT) before the introduction of Goods and Services Tax (GST) was 12.5%. This was applicable on all goods and services which were taxable. The rate of VAT could vary from state to state and from product to product. The taxpayer had to pay the applicable rate of VAT to the state government.

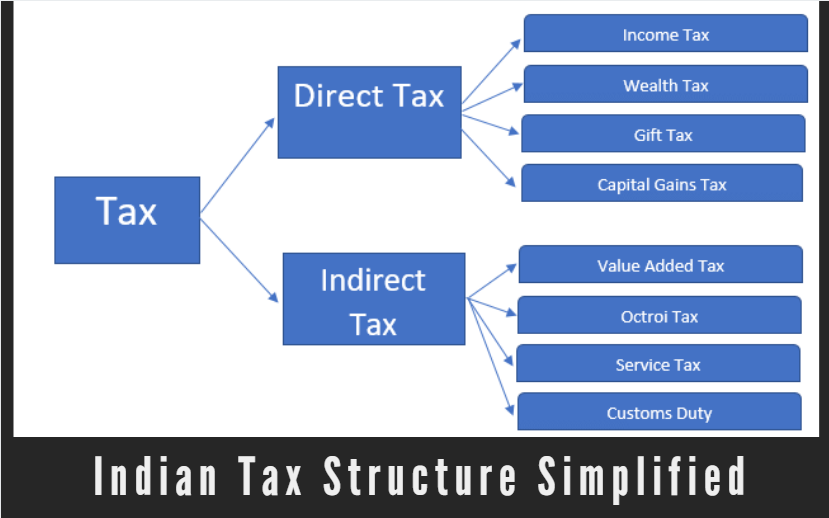

Earlier, before the introduction of GST in India, the indirect tax system was governed by the Central Excise Act, 1944 and the Central Sales Tax Act, 1956. The Central Excise Act dealt with the taxation of manufacturing activities and the Central Sales Tax Act dealt with the taxation of inter-state movement of goods and services.

The taxation of services was a major challenge before the introduction of GST in India. Services were not taxed at a uniform rate across the country and different taxes were applicable on different services in different states. In addition, there was no concept of Input Tax Credit (ITC) and the taxes paid on input services or goods could not be adjusted against the taxes paid on output services or goods.

In addition to the above, there were several other taxes that were applicable on goods and services before the introduction of GST. These included Octroi, Luxury Tax, Entertainment Tax, etc. These taxes were applicable in different states and had different rate structures. As a result, the compliance burden on businesses was very high. GST has revolutionized the indirect tax system in India and has made it much simpler for businesses. All the different taxes have been subsumed into one single tax and the compliance burden has been reduced significantly. The concept of Input Tax Credit has also made it simpler for businesses to adjust taxes paid on inputs against the taxes paid on output services or goods.